Medium-to long-term environmental targets

Medium- to long-term environmental targets

The SMFL Group formulated its environmental policy in June 2017, explicitly stating its aims in contributing to the resolution of global environmental issues. In April 2020, as one element of Our Vision within the SMFL Way, the Group declared its intention to become a company “Chosen for its commitment to SDGs,” and since then has been working on various initiatives.

In October 2020, the Japanese government declared its intention for Japan to achieve carbon neutrality by 2050 and has been promoting the decarbonization of society by encouraging companies to take actions. Furthermore, the SMBC Group has announced its goal to be carbon neutral in terms of greenhouse gas emissions for its entire investment and financing portfolio by 2050, and the Sumitomo Corporation Group has likewise declared a goal of carbon neutrality for business activities Group-wide by 2050.

The SMFL Group, in the meantime, established medium- to long-term environmental targets in April 2022, with the intention of contributing to the sustainable growth of the Group by achieving those targets.

The medium- to long-term environmental targets embrace three objectives. Target 1 and Target 2 are related to the decarbonization of the Company and the Group, and Target 3 aims to contribute to resolving social issues, including the decarbonization of our customers.

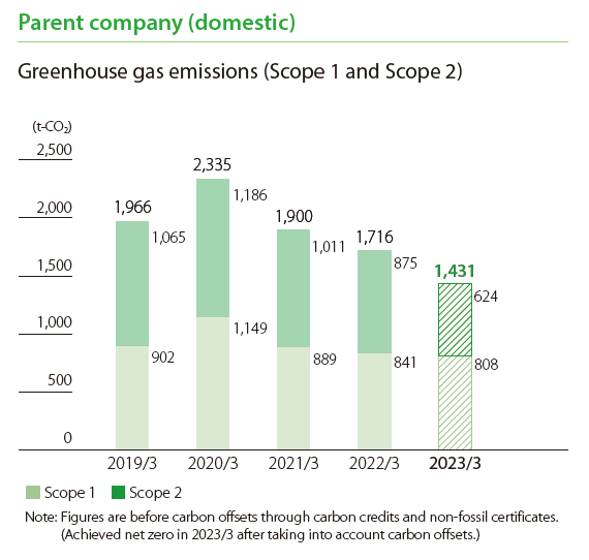

Medium- to long-term targets for reducing greenhouse gas emissions

Target 1: Net-zero greenhouse gas emissions by the Company【Achieved】

Our original target was for the Company (non-consolidated) to achieve net-zero greenhouse gas emissions (Scope 1 and Scope 2) in Japan by FY2023. In fact, we achieved that target a year ahead of schedule, in FY2022.

To do so, we worked to reduce gasoline consumption by optimizing the number of Company vehicles owned and their forms of ownership, reduced fuel and electricity consumption by consolidating offices, and have been switching to renewable energy sources for electricity at major locations in Japan.

In addition, through the acquisition of non-fossil certificates generated by solar power generation facilities operated by the Group, we are effectively procuring electricity from renewable energy sources.

Furthermore, we offset our carbon emissions through the use of carbon credits.

Target 2: Net-zero greenhouse gas emissions by the Group

We have set a Group (consolidated) target of achieving net-zero greenhouse gas emissions (Scope 1 and Scope 2) by FY2025. While leveraging our experience in efforts to achieve Target 1, we will work with specific overseas branches, overseas subsidiaries, and Group companies to achieve the target.

Introduction of renewable energy at major locations in Japan

To achieve our medium- to long-term environmental goals, we have switched to renewable energy at our major locations in Japan, starting with the introduction of renewable energy at our Tokyo Head Office in April 2022, followed by major locations in Osaka, Kobe, and other areas. In addition, the Company(non-consolidated) uses FIT non-fossil certificates with tracking for solar power generation facilities owned by Group company SMFL MIRAI Partners to cover our domestic greenhouse gas emissions, in effect using renewable energy sources within the Group.

In the future, we will switch to using electricity from renewable energy sources at offices in Japan that do not already do so, including those of Group companies.

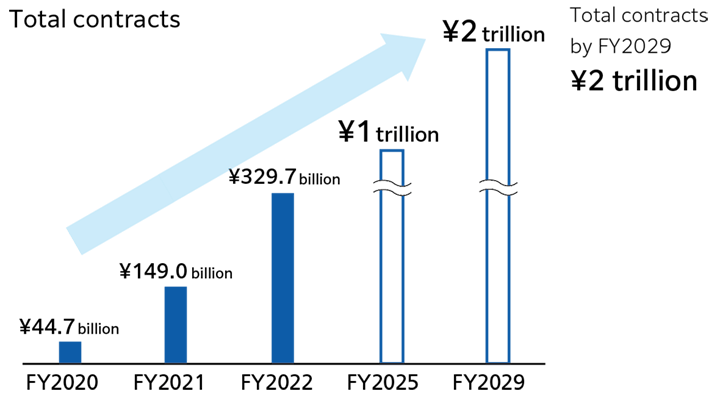

Target 3: Expand sustainability businesses

The Group is focusing on sustainability businesses in order to contribute to resolving social issues such as climate change, and this includes supporting decarbonization by our customers. We have set a medium-term target for the cumulative contract value of sustainability business transactions, beginning

from FY2020, and have been accelerating our business development.

Amid growing customer interest in sustainability, the cumulative contract value reached approximately ¥330 billion in the three years through FY2022. Harnessing the momentum of this progress, in June 2023 we announced that we would bring forward the target year for Target 3 (Cumulative contract value of ¥1 trillion in sustainability businesses by FY2029) to FY2025, and raise the target for FY2029 to a cumulative contract value of ¥2 trillion.

Going forward, we will continue to develop products and services that contribute to resolving social issues and expand the Group’s sustainability businesses in order to achieve our targets.

Main transactions(FY2020–)

- Investment in and financing of renewable energy power generation businesses such as solar, wind, hydro and biomass

- SDGs Lease MIRAI 2030® (donation type)/(evaluation type) scheme, SDGs leases in collaboration with companies and government agencies

- Sustainability-linked leases and loans for ships utilizing the framework of the Poseidon Principles in which we participate

Additional main transactions(FY2022–)

- Environmentally certified real estate development and financing

- Sustainability-linked leases (beyond those for ships)

- SDGs rental

Showcase transactions

Biomass power generation using locally sourced wood chips

Providing a lease for a next-generation zero-emission electric-powered tanker

Start of operations at JRE Aso Takamori Solar Power Plant

Providing bridge loan during construction for wind farm