Operating Leases

Capital investment at low cost and off the balance sheet.

Outline of the Transactions

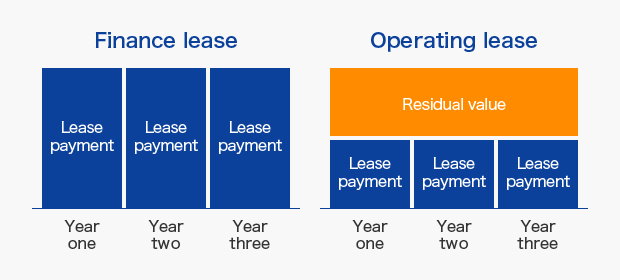

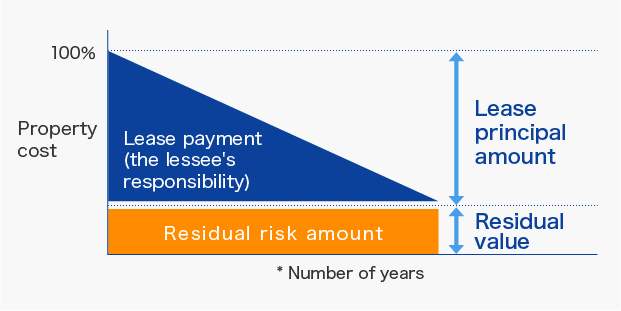

- In the case of operating leases, the leasing company examines the value of the equipment after the expiration of the lease term (residual value), and then subtracts the residual value from the price of the item. The customer then pays the difference between the original price of the equipment and the residual value.

- Since SMFL takes the risk in principle of the future value of the item, customers can receive the benefits of paying substantially lower lease rents. In addition, by designing the operating lease according to the accounting and tax regulations, operating leases can be effective in realizing clients’ financial strategy of keeping items off the balance sheet.

- SMFL provides operating lease financing for semiconductor manufacturing equipment, machine tools, civil engineering and construction machinery, medical equipment, and many other items as well as respond to a diverse range of customer needs.

Please enlarge and see.

Please enlarge and see.

Features and Advantages

- Since the length of terms for operating leases can be set for shorter terms in comparison with finance leases, it is possible to prevent the risk of equipment obsolescence in industries where the pace of technology change is extremely rapid.

- In cases where the rate of equipment utilization in the future because of declines in orders or other circumstances, operating leases are an effective means of dealing with excess production capacity.

- Under the new accounting standards that came into effect in 2008 and subsequent years, since it is possible to place leased assets off the balance sheet by setting a residual value that is above a certain percentage, operating leases are highly effective for the management of financial indicators, such as the shareholders’ equity ratio and return on assets (ROA).

Principal Leased Items

- Semiconductor manufacturing equipment

- Machine tool

- Printing machine

- Construction machinery

- Excavator

- Wheel loader

- Bulldozer

- *Please note that this scheme may not be employed depending on the type of equipment.