Japanese Operating Leases

Under these arrangements, the lessor (an operating company) can receive investments from investors and raise funds from financial institutions to purchase large-scale aircraft, shipping, and other assets. The lessor can return the tax benefits, which accrue to investors in connection with deferred payments, to the lessee (the user of the asset) in the form of lower lease fees.

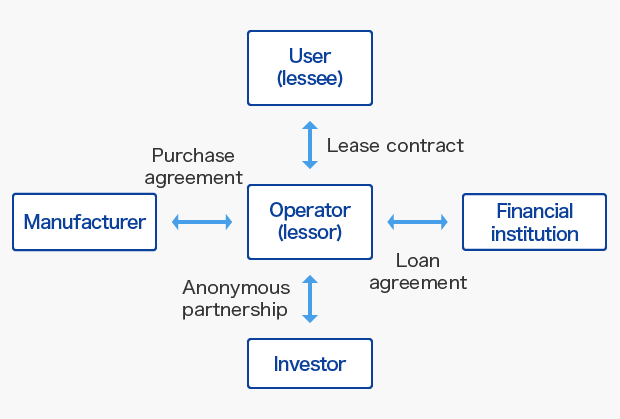

Outline of the Transactions

Please enlarge and see.

- Note:Anonymous partnership agreement based on Articles 535-542 of the Commercial Code. Investors receive a percentage of leasing business profits and cash distributions from the operating company in accordance with their ownership ratio.

- *Arrangements for placement of investors in Japanese Operating Leases are handled by the SMFL Investment Business Department.

- *These arrangements are applicable to regular Japanese companies, such as stock-issuing corporations, and cannot be used by individuals or individual proprietorships.

- *Anonymous partnership agreement based on Articles 535-542 of the Commercial Code. Investors receive a percentage of leasing business profits and cash distributions from the operating company in accordance with their ownership ratio.

Features and Advantages

- Investors can realize the benefits of large depreciation write-offs with relatively small investments.

The benefits obtainable are the same as having ownership of a depreciable item that has a value of two to four times the investment.

- *Please note that, as a result of revisions in the tax laws in 2005, there is now a cap on the accumulated losses that can be recognized for tax purposes.

- An efficient use of cash. As a result of the benefits of deferred payments, cash is retained, and effective use of cash is possible.

Notes about Japanese Operating Leases

- Investment-related fees

Investors in Japanese Operating Leases are required to pay structuring fees (including costs for the documentation process), and sales commissions to cover the interest for the period from our initial investment to the date of investment by the investors; the amounts of commissions are relative to each transaction, and the financial and legal details of the transaction are carefully explained to the investor. The aforementioned fees/commissions are included in the consideration for transfer in proportion with the percentage of investment.

- Investment risks

The Japanese Operating Lease business does not guarantee a return on investments, and a portion or the full amount of the investment may not be retrieved (including any additional investments*). Moreover, a portion or the full amount of the investment may be irretrievable due to fluctuations in foreign exchange rates and interest rates over the course of the business operation.

- *In circumstances that require further funds in order to proceed with the business operation, additional investments within set limits may be necessary.

| Financial Instrument Dealer | Sumitomo Mitsui Finance and Leasing, Company |

|---|---|

| Financial Instrument Dealer Registration Number | Director of Kanto Local Finance Bureau (Financial instruments firms) No.1930 |