Sustainable Finance

What is Sustainable Finance?

Sustainable finance refers to the provision of finance to help achieve a sustainable society. (Expert Panel on Sustainable Finance of Japan's Financial Services Agency)

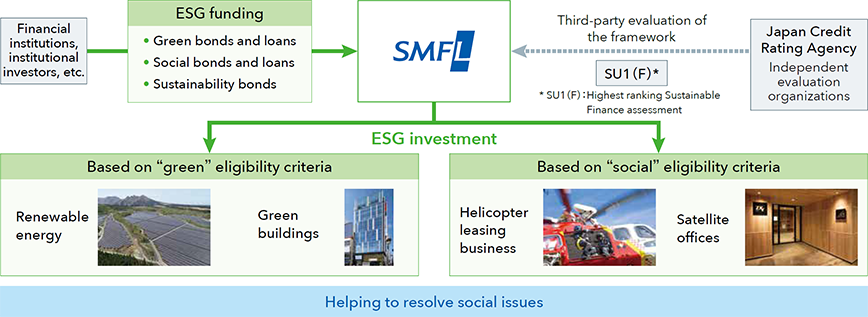

Since formulating its Green Bond Framework in FY2019 and Sustainable Finance Framework in FY2022, SMFL has engaged in sustainable finance activities totaling approximately ¥65 billion through FY2024. Looking ahead, we will work diligently to garner the understanding of stakeholders toward our commitment to solving social issues, which includes achieving the SDGs. On this basis, we will proactively procure sustainable finance for use in fulfilling this commitment and provide various investment opportunities to investors and financial institutions.

Sustainable Finance Framework

SMFL procures and manages funds as part of its sustainable finance activities based on a framework established in accordance with the following criteria:

- The Green Bond Principles 2022 issued by the International Capital Market Association (ICMA)

- The Green Loan Principles 2023 issued by the Loan Market Association (LMA), Asia Pacific Loan Market Association (APLMA), Loan Syndication and Trading Association (LSTA)

- Green Bond Guidelines 2022 (Japan's Ministry of the Environment)

- Green Loan Guidelines 2022 (Japan's Ministry of the Environment)

- Social Bond Principles 2023 (ICMA)

- Social Loan Principles 2023 (LMA, APLMA, LSTA)

- Social Bond Guidelines 2021 (Japan's Financial Services Agency)

- Sustainability Bond Guidelines 2021 (ICMA)

SMFL has obtained the highest ranking sustainability framework assessment of SU1 (F) from Japan Credit Rating Agency, Ltd. as a third-party evaluation for this framework.

| Second-Party Opinion Japan Credit Rating Agency, Ltd. (JCR) | Second-Party Opinion(PDF : 872KB) |

|---|

Issuance track record

Positive Impact Finance

Positive Impact Finance is based on the Principles for Positive Impact Finance proposed by the United Nations Environment Programme Finance Initiative. It is a financing method through which financial institutions comprehensively analyze and evaluate both the positive and negative impact corporate activities have on the environment, society, and economy for the purpose of providing ongoing support for ESG activities.

Third-party opinion on positive impact finance is as follows:

| Third-Party Opinion on Positive Impact Finance provided by MUFG Bank, Ltd. |

Third-Party Opinion(PDF : 1,362KB) |

|---|

Sustainability-Linked Loans

A sustainability-linked loan is a loan that is designed to achieve sustainable growth for the borrower and society by establishing sustainability performance targets (SPTs) that are consistent with the borrower’s sustainability strategy and appropriate key performance indicators (KPIs) that help upgrade the borrower’s sustainability management while also linking SPTs with the terms and conditions of the loan based on the Sustainability-Linked Loan Principles and Green Loan and Sustainability-Linked Loan Guidelines.

Positive impact finance self-assessment results are as follows:

| Sustainability-Linked Loan with Engagement Dialogue with Development Bank of Japan Inc. |

Self-Assessment Results (PDF : 1,387KB) |

Independent Practitioner's Assurance Report (PDF : 3.2MB) |

|---|