Compliance

Toward strengthening the compliance structure to adapt to expanding and diversifying business models

SMFL is promoting measures to ensure the compliance first culture and to establish a compliance structure suited to the characteristics of each business so that we can establish business foundation.

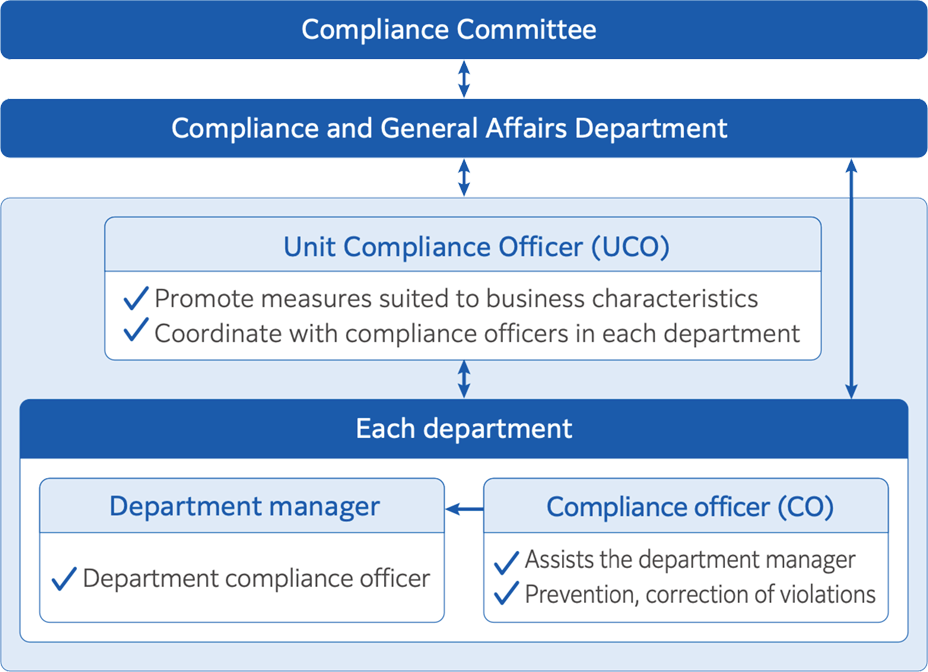

Structure for Promoting Compliance

SMFL established the Compliance Committee. Chaired by Managing Executive Officer in charge of the Compliance and General Affairs Department, this Committee in principle meets twice a year and discuss various compliance-related measures.

On an organizational unit basis, each department manager is responsible for compliance. A Compliance Officer is assigned to each department to assist the general manager in ensuring that all employees are fully aware of the laws, regulations, and internal rules related to business operations.

Unit Compliance Officers are assigned to each business unit to collect and collate information on laws, regulations, and industry trends suited to the characteristics of each business unit, and to provide guidance and support to general managers and compliance officers under relevant business unit.

Promote Compliance Initiatives

As part of our annual plan, we are formulating a compliance program while working to foster a compliance culture, establish a risk management system, and share information among departments.

| Items | Description |

|---|---|

| Fostering a compliance culture | Information dissemination, including messages from the President, and compliance sessions for all officers and employees (approximately 90% of domestic employees participated) |

| Instill a Compliance-first Culture |

Fixed-point measurement of the degree of awareness toward a compliance-first culture using compliance questionnaires |

| Enhance the Risk Management System | In addition to strengthening the risk management analysis of new businesses, we will work to entrench management systems through training and monitoring |

| Support the development of risk management systems at overseas locations and each department | We are developing overseas locations and Group company systems suited to business characteristics while implementing compliance measures for new business ventures |

| Compliance personnel exchanges in each department | Regular information sharing and the promotion of communication between organizations |

Information Management

We have established our policy regarding the appropriate protection and use of customer information in our Privacy Policy.

Details regarding management systems are specified in "Handling of Customerʼs Personal Information."

Prevention of Bribery

We thoroughly disseminate information regarding regulations for preventing bribery to all officers and employees, as well as regularly monitor compliance with various regulations.

Cutting Off Relations with Antisocial Forces, and Anti-Money Laundering/Combating the Financing of Terrorism

We have established basic Group-wide policies on cutting off ties with antisocial forces and preventing money laundering and terrorist financing. Working in unison as the SMFL Group, we are taking steps to establish systems and respond appropriately.

Whistleblowing System

In order to self-cleanse where violations of laws or regulations are discovered and corrected at an early stage, and to protect whistleblowers, we have put in place an internal whistleblowing system.

| Hotline | Description |

|---|---|

| SMFL Alarm Line (internal hotline) |

|

| SMFL Hotline (external hotline) |

|

| SMBC Group Alarm Line |

|

| SMFG Accounting and Audit Hotline |

|