Environmental Policy / Medium-to Long-Term Environmental Targets / Achievements

Environmental Policy

Basic Philosophy

Recognizing that efforts to address environmental problems are an important responsibility to be fulfilled for society, Sumitomo Mitsui Finance and Leasing Co., Ltd. hereby establishes the following Environmental Policy.

Environmental Policy

- Through our business, we will actively work to harmonize global environmental preservation and pollution prevention with our corporate activities, and contribute to society and the economy.

- We actively engage in the leasing and rental of equipment that reduces environmental impact, as well as the reuse and proper disposal of equipment whose lease terms have expired. We support our customers' efforts to address environmental issues by providing information and solutions.

- We will strive to reduce our environmental impact by conserving resources and energy, and by reducing, reusing and recycling waste.

- We will comply with environmental laws and regulations.

- To achieve this policy, we will set environmental objectives and targets, reviewing them periodically to ensure the continuous improvement of our environmental management system.

- We will strive to ensure that all employees are fully aware of this policy, and will disclose it in writing broadly outside the Company.

Tetsuro Imaeda

President

Sumitomo Mitsui Finance and Leasing Co., Ltd.

Medium- to Long-Term Environmental Targets

The SMFL Group formulated its environmental policy in June 2017, explicitly stating its aims in contributing to the resolution of global environmental issues. In April 2020, as one element of Our Vision within the SMFL Way, the SMFL Group declared its intention to become a company "chosen for its commitment to SDGs," and since then has been working on various initiatives. In April 2022, we established three medium- to long-term environmental targets. Targets 1 and 2 are related to the decarbonization of SMFL and the SMFL Group, and under Target 3 we aim to contribute to resolving social issues, including the decarbonization of our customers' operations.

Medium- to long-term targets for reducing GHG emissions

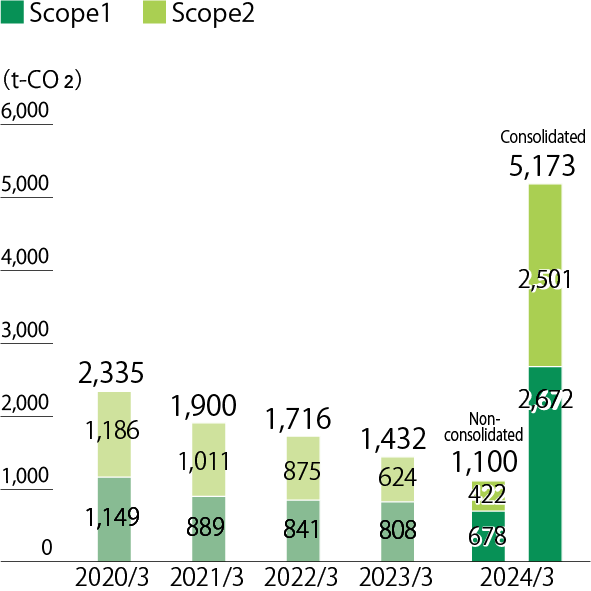

Target 1 Net-zero greenhouse gas emissions by SMFL in Japan (up to FY2023) (Achieved)

We achieved Target 1 one year ahead of schedule in FY2022 and maintained net-zero emissions in FY2023 and FY2024.Given that the majority of our Scope 1 emissions are due to gasoline use in company vehicles, we have been taking measures to reduce its gasoline consumption. These measures include a 37% reduction in the number of vehicles by the end of FY2024 compared to FY2021, and simultaneously replacing them with environmentally friendly alternatives. We have offset any remaining Scope 1 emissions after implementing these measures through the use of carbon credits. For Scope 2 emissions, we have set and achieved our goal of sourcing all electricity used from renewable energy sources on a non-consolidated basis in Japan. This includes switching to renewable energy sources and utilizing non-fossil fuel certificates. Furthermore, we used all of the non-fossil certificates derived from the solar power facilities owned by the SMFL Group, while ensuring the continuity and transparency of our renewable energy procurement within the SMFL Group, from generation to consumption, over the long term.

Greenhouse gas emissions(Scope 1 and Scope 2)

- ※Scope 2 emissions are after the application of non-fossil fuel certificates on SMFL offices in Japan. (Prior to application: 624 t-CO2e in FY2022, 2,460 t-CO2e in FY2023 and 1,513 t-CO2e in FY2024)

- ※() indicates the figure on a non-consolidated basis in Japan

| Vehicles | Vehicles reduced | |

|---|---|---|

| FY2021 | 374 | ▲29 |

| FY2022 | 336 | ▲38 |

| FY2023 | 286 | ▲50 |

| FY2024 | 235 | ▲51 |

Target 2: Net-zero greenhouse gas emissions by the SMFL Group (by FY2025)

To calculate the SMFL Group's GHG emissions more precisely, we introduced a cloud system for calculating GHG emissions in April 2024. Additionally, SMFL Group has obtained third-party assurance for its Scope 1 and 2 GHG emissions for FY2024. Toward achieving environmental Target 2, we will further promote activities to reduce the SMFL Group's GHG emissions and procure carbon credits, non-fossil fuel certificates, and overseas renewable energy certificates.

| t-CO2e | FY2023 | FY2024 | Emissions factors/Notes |

|---|---|---|---|

| Scope 1 | 2,665 | 3,223 | In principle, we use the emission factors published in the Greenhouse Gas Emissions Accounting, Reporting and Disclosure System under Japan's Act on Promotion of Global Warming Countermeasures to calculate Scope 1 emissions. For Scope 1 emissions, SMBC Aviation Capital's share is recorded as 1,541 t-CO2e for FY2023 and 2,414 t-CO2e for FY2024. |

| Scope 2 | 2,034 | 1,309 | In principle, we use the provider-specific emission factors; otherwise, we use the country-specific emission factors published by IEA (International Energy Agency). Due to the review of the calculation Boundary, Scope 2 emissions for FY2023 were revised. Scope 2 emissions are after the application of non-fossil fuel certificates on SMFL in Japan. (Prior to application: 2,460 t-CO2e for FY2023 and 1,513 t-CO2e for FY2024) |

Assurance

SMFL Group's Scope 1, 2 emissions are obtained independent limited assurance performed by KPMG AZSA Sustainability CO., Ltd.

| Fiscal Year | Independent Practitioner's Assurance Report |

|---|---|

| 2024 | Assurance Report(4.5MB) |

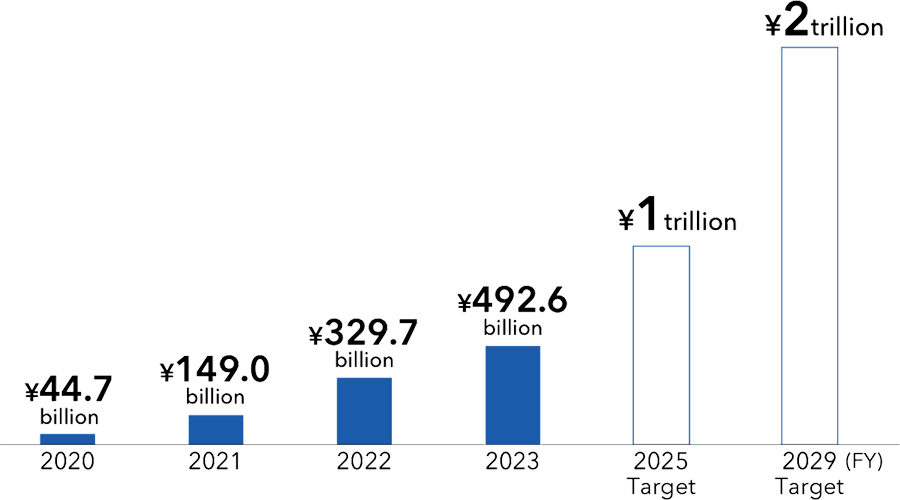

Target 3: Expand sustainability -related businesses

The SMFL Group is focusing on sustainability -related businesses to help address social issues, including climate issues, and to support customers in their decarbonization efforts. Initially, we set a cumulative contract value target of ¥1 trillion for FY2020 to FY2029, but we have moved this target date forward to FY2025 while raising the cumulative target to ¥2 trillion for FY2029.

Driven by our customers' growing interest in sustainability, the cumulative contract value for sustainability-related businesses reached ¥775.9 billion over the five years to FY2024. We will continue to accelerate our efforts in each business to achieve these targets.

Cumulative contract value

Main transactions (FY2020–)

- Investment in and financing of renewable energy power generation businesses such as solar, wind, hydro and biomass

- Environmentally certified real estate development and financing projects

- SDGs Lease Mirai 2030® (donation type) /(evaluation type), SDGs leases in collaboration with companies and government agencies, real estate version of SDGs leases, etc.

- Sustainability-linked leases and loans (included from FY2023)

- Leases including carbon credits (included from FY2024)

- *The inclusion of transactions related to sustainability in the aggregation target is subject to approval by the SDGs Promotion Committee.

GHG Emissions Data

In addition to the measurement and disclosure of Scope 1 and Scope 2 emissions, society is demanding the disclosure of Scope 3 emissions, which cover indirect emissions from sources other than a company itself. SMSL has been calculating data for certain categories within Scope 3 (refer to the following table) since FY2023. Moving forward, we will work on expanding both the categories and the scope of disclosure.

| t-CO2e | FY2023 | FY2024 | |

|---|---|---|---|

| Scope 1 *1 *4 |

Consolidated total | 2,665 | 3,223 |

| Of which SMBC AC | 1,541 | 2,414 | |

| Scope 2 *2 *3 *4 |

Market-based | 2,034 | 1,309 |

| Location-based | 3,984 | 3,523 | |

| Scope 3 | Category 1 (purchased goods and services) | 41,252 | 46,728 |

| Category 2 (capital goods) | 5,084,865 | 5,199,682 | |

| Category 3 (fuel- and energy-related activities) *3 | 797 | 624 | |

| Category 5 (waste generated in operations) *5 *6 *7 | 32 | 142 | |

| Of which office waste | 3 | 11 | |

| Of which business asset waste | 29 | 131 | |

| Category 6 (business trips) *8 | 5,589 | 12,998 | |

| Category 7 (employee commuting) *8 | 719 | 1,105 | |

| Category 13 (lease assets (downstream)) *9 | 17,276,999 | 17,627,922 | |

| Of which aircraft | 16,241,114 | 16,755,224 | |

| Of which other transportation equipment | 1,035,885 | 872,698 |

- *1 In principle, we use the emission factors published in the Greenhouse Gas Emissions Accounting, Reporting and Disclosure System under Japanʼs Act on Promotion of Global Warming Countermeasures to calculate Scope 1 emissions.

- *2 In principle, we use the provider-specific emission factors; otherwise, we use the country-specific emission factors published by IEA to calculate Scope 2 emissions.

- *3 Due to the review of the calculation boundary, Scope 2 emissions for FY2023 were revised.

- *4 SMFL Group has obtained third-party assurance for its Scope 1 and 2 emissions for FY2024.

- *5 Emissions that were recorded as category 12 from FY2023 have been reclassified as category 5 in line with the revision to methodology.

- *6 Data is complied from companies for which data is available.

- *7 FY2023 data is calculated for SMFL and domestic affiliates occupying the following offices (Tokyo Head Office, Osaka Head Office, Takebashi Office).

- *8 FY2023 data is calculated for SMFL and SMFL MIRAI Partners Co., Ltd.

- *9 Scope 3 Category 13 is calculated based on aircrafts owned by SMBC AC and other transportation equipment under lease contracts with SMFL and may increase in the future as assets subject to calculation expand.

Energy Consumption

| Type of energy | Non-consolidated | Consolidated | ||||

|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2024 | 2023 | 2024 | |

| Gasoline [kL] | 338 | 326 | 274 | 209 | 457 | 321 |

| Jet fuel [t] | - | - | - | - | 286 | 448 |

| Diesel fuel [kL] | 0 | 0 | 2 | 3 | 6 | 4 |

| City gas [thousands m³] | 25 | 23 | 23 | 24 | 30 | 31 |

| Electricity [MWh] | 1,915 | 1,979 | 2,272 | 2,369 | 8,895 | 8,045 |

| Of which renewable electricity [MWh] | 0 | 1,880 | 2,135 | 2,223 | 4,471 | 5,316 |

| Renewable energy ratio (%) | 0 | 95.0 | 94.0 | 93.8 | 50.3 | 66.1 |

| Cooling water [GJ] | - | - | - | - | 616 | 572 |

- ※ Renewable electricity includes the amount of non-fossil fuel certificates purchased.

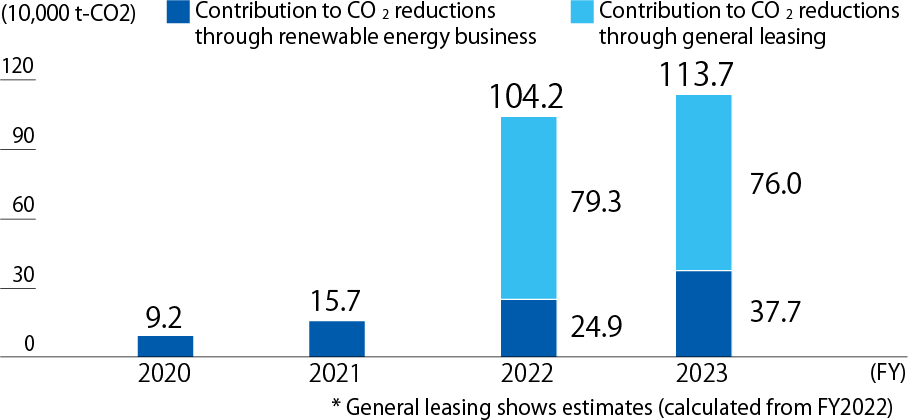

Estimates of Avoided Emissions

Aiming to create social value and expand economic value, we began measuring our contribution to avoided emissions as an impact indicator that reflects the influence of our business activities on society and the environment from FY2020. Having recorded 510,000 t-CO2 from renewable energy generation projects in FY2024, our avoided emissions has remained on an upward trend. Including general leasing transactions, the total avoided emissions amounted to 1,190,000 t-CO2. Going forward, we will work to increase our avoided emissions throughout the supply chain, including power generation, storage, and energy conservation, and thereby contribute to the realization of a decarbonized society.

Avoided emissions

| Renewable energy business | General leasing | |

|---|---|---|

| Scope of calculation | In-house power generation (including PPA), financing and project finance projects handled by the Global Environment Business Unit | General leasing projects for renewable energy equipment handled by the Corporate Business Unit |

| Applicable power generation methods | Solar power, wind power, hydro power, biomass, geothermal | Same as on the left |

| Calculation method | Avoided emissions are calculated by multiplying our share of power generation in each fiscal year by the International Energy Agency (IEA) emission factor. | Avoided emissions are calculated by multiplying the power generation capacity determined by a specific logic, capacity utilization rate and the IEA emission factor. |

Targets related to Japan's Act on the Promotion of Plastic Resources Circulation

In response to the Act on Promotion of Resource Circulation for Plastics, which came into effect in April 2022, SMFL set two key targets. The first target, announced in June 2023, focuses on reducing the disposal of plastic office supplies used in business activities, and the second target, announced in March 2024, addresses the reprocessing of properties at the end of their leases.

Target 1 Reduction of plastic office supplies used in business activities (Achieved)

- Recycle 100% of used clear files by FY2025

- Ensure that 100% of newly purchased clear files are made from non- plastic materials by FY2025

Target 2 Reprocessing of lease-end assets

- Resource recycling ratio ※ Maintain the 92.8% result achieved in FY2022

- ※The resource recycling ratio is the sum of the re-leasing rate for lease agreements, the ratio of end-of-lease properties sales, and the recycling ratio of end-of-lease properties. This indicator is aimed at promoting resource circulation by maximizing the reuse and recycling of leased properties.

| FY | Resource recycling ratio(%) |

|---|---|

| 2020 | 92.0 |

| 2021 | 91.5 |

| 2022 | 92.8 |

| 2023 | 91.9 |

| 2024 | 92.0 |

In-house initiatives

Since December 2023, SMFL's clear files are converted into paper-based materials which can be collected for recycling. Through the repetitive in-house use of plastic clear files we have achieved target (1).

In addition, we have replaced approximately 20,000 plastic PET bottles used in service of our customers at locations in Japan annually with PET bottles made of aluminum and steel from FY2024.