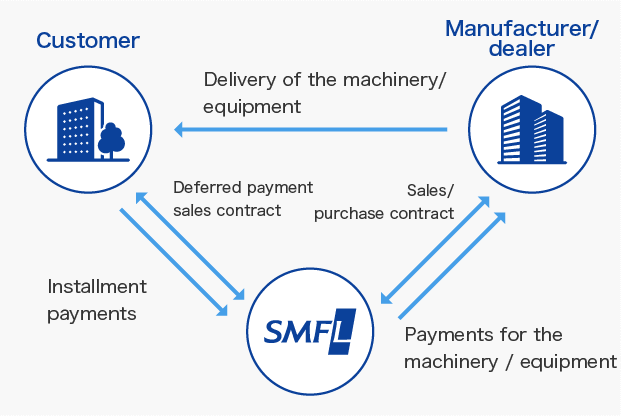

Installment Sales

Under these arrangements, SMFL purchases the equipment selected by the client and sells it to the client through long-term, installment payments.

Outline of the Transactions

- In principle, payment terms call for monthly payments in equal amounts, but payments can be set to match the client’s cash flow plans.

- Unlike leasing, ownership rights belong to the client; therefore, the item will be included in fixed (non-current) assets, and the client must depreciate the assets and pay fixed asset taxes. However, ownership will remain with SMFL until all installment payments are paid.

Please enlarge and see.

Features and Advantages

The equipment becomes the property of the client after the maturity of the contract. Since the issue of whether the equipment is movable or not does not arise, this arrangement is preferable to leasing and is recommended for equipment that is suited to ownership by the customer.

- Reduces up-front costs

- Since payments are made in installments, the initial cost of putting the item into service is reduced substantially.

- Diversifies fund sources

- Since these arrangements enable clients to tap another source of funding, this provides for leeway in client cash and funding capacity.

- Ownership of the item

- Unlike leases, after the completion of all installment payments, the ownership of the item passes to the client.